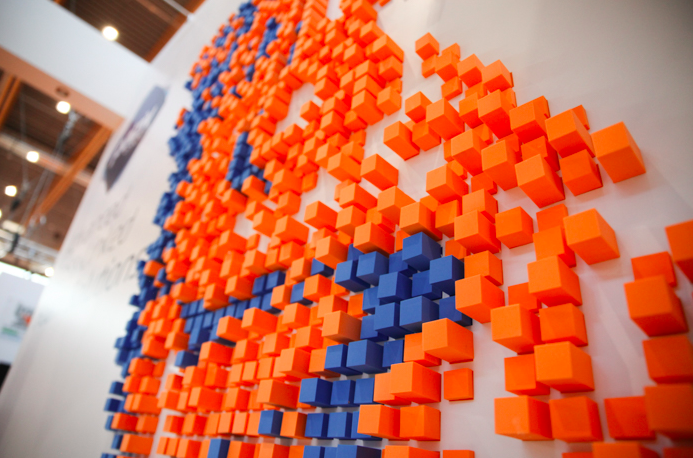

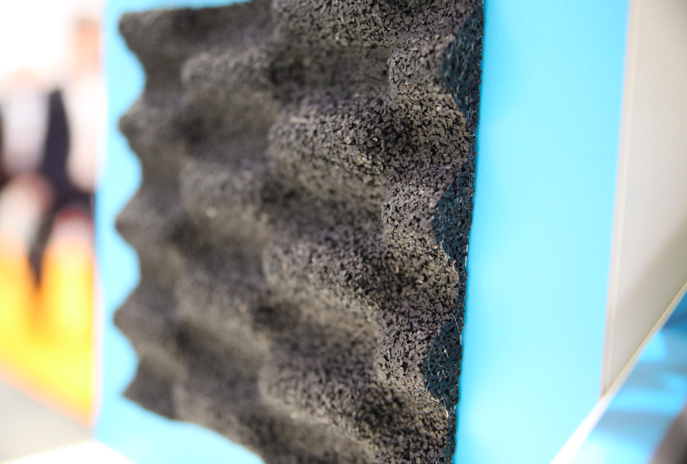

Foam Expo is the right place to source the latest technologies and manufacturing innovations to stay ahead of your competitors. It is the best venue to discover new solutions to solve your manufacturing challenges and optimize your products. It is also the best place to meet over 500 specialist suppliers form all sectors of the foam and adhesive supply chains. The show is an ideal place to learn the latest trends challenges and opportunities experts at free-to-attend conferences.

During the period between April 16, 2020 and May 6, 2020, Foam Expo and the Adhesives & Bonding Expo reached out to its community of end-users and OEMs, foam and adhesives manufacturers, converters and fabricators, raw material and chemical suppliers, to understand how the Covid-19 pandemic is having an impact on their businesses, and what the effects and consequences may be for the supply chain in the longer term.

Through an anonymous online survey, 224 industry professionals shared their insight and sentiment during that challenging time. The organizers of the show arranged a comprehensive report with the results of the survey which benchmarks the status of the foam and adhesives & bonding supply chains. They invited a panel of four industry experts to review the results in a live webinar and discuss the current status of the market and how they view the future of the industries. Some of the points they made were included in the report.

The survey is representative of the whole supply chain as there is a relatively even spread in responses from different tiers, though it is worth pointing out that the majority of the respondents seem to be in some kind of leadership role either as manager or senior executive, which makes up 85% of the total.

In addition, a majority of 59% work for small to medium sized companies (up to a size of 500 employees) and are predominantly based in North America (84%) as only 9% indicated to be based in Europe and 4% said they were based in Asia Pacific. The remaining 3% is based in Latin America and Africa.

The majority of respondents indicated their company’s growth was performing well before the outbreak: 74% of the organizations either performed in-line with projections or were sustainably performing beyond projections. Segmentation of the results into the specific tiers in the supply chain shows a similar pattern across all categories.

Automotive, construction and packaging were the top performing markets before the pandemic.

The report of Adhesives & Bonding Expo details the impact of the pandemic by months and offers valuable information about the industry as below:

Given the spread of the virus from the end of December 2019 throughout China and the rest of East Asia, some business already started noticing economic impact before the virus outbreak was declared

a pandemic by the WHO on March 11, 2020. Although only 9% of the total respondents indicated to have started noticing an impact as early as January, nearly a quarter (23%) of end-users / OEMs / component manufacturers said they started noticing the impact during this month.

A fifth of the total respondents started noticing the economic impact in February: it consisted of 29% of the testing and engineering services, 22% of the suppliers of chemicals / raw materials / additives and 21% of the foam and adhesives & bonding manufacturers.

65% of all organizations indicate March as the month they started to feel the economic impact. On March 11, 2020, President Trump suspended nearly all foreign travel as a response to the WHO’s categorization of

the disease as a pandemic and most states had entered lockdown by the end of the month. A majority of converters and fabricators (72%), foam and adhesives and bonding manufacturers (66%), chemicals

/ raw materials / additives suppliers (64%) and end-user / OEMs / component manufacturers (57%) all started to take a hit during this time.

Only 7% of organizations are saying they were not yet experiencing any economic impact at the time of the survey, within this group a third are foam and adhesives manufacturers and a fifth converter / fabricators.

Looking ahead – how will Covid-19 impact the future of the Foam and Adhesives & Bonding Supply Chain

In order to get some insight into how the pandemic has affected business priorities and investment strategies for companies within the foam adhesives supply chains we asked the respondents to indicate how their businesses prioritized certain activities before the pandemic, which activities continued during the pandemic, and how much strategic investment they expect for these activities over the next 24 months.

Prior to the outbreak of the pandemic in March, the foam and adhesives & bonding supply chain prioritized the following business activities: corporate sustainability, new product development and launching products, sales and account management, R&D, and marketing and business development.

During the pandemic, most business activities were down to minimal operationality, although sales and account management as well as marketing and business development continued on reduced activity levels.

Looking ahead, industry professionals expect that sales and account management and marketing and business development will become more important in future investment strategies.

It seems the supply chain will mainly be consolidating their manufacturing activities as respondents expect that there will be slightly less investment in hiring and developing talent, expanding manufacturing capacities and mergers & acquisitions.

Future outlook on business plans

While much will remain uncertain for the ongoing future, it is important to look ahead to how the industry can and will recover from this period of severe disruption. Our respondents do expect increased investment in sales and account management, and marketing and business development, undoubtably to try and recover the losses brought on by the crisis.

When asked about the top challenges in ensuring business continuity, respondents indicated that a reduction in orders and sales is the biggest challenge for their business at present. Otherwise, it seems the supply chain is relatively robust in their ability to deliver raw materials and fulfilling & delivering orders. This is reinforced by the results of the sentiment poll. The majority

of the respondents feel there is enough inventory and availability of materials and components to continue production in the event of a prolonged disruption in the supply chain.

They are less optimistic regarding the impact on a business’ revenue. As economies globally are taking a hit and supply chains and demand have slowed down, it is difficult to say how the impact on revenue will develop in the coming months, though the rise in demand within the medical and pharma sectors, and the fact that many companies throughout the supply chain are able to continue their manufacturing activities, offers many new opportunities.

Finally, we investigated sentiment towards their employer’s handling of the crisis and the impact on their own work life.

On average, respondents indicated to be optimistic regarding their employer’s preparedness to the outbreak of the pandemic, as well as its communications to employees and customers. They do not feel that working remotely has impacted their personal situation much, such as keeping up productivity while working from home and maintaining a work-life balance. Of course, it must be noted that the majority of respondents are in a leadership role themselves.

However, 23% of the respondents do feel that there was room for improvement. When asked to elaborate if their organization could have done to better prepare for the outbreak some of their feedback included:

better support for working from home, better and faster communication, contingency plans, better availability of virtual tools, identifying which customers were vulnerable for shutdown, embracing technology sooner, stock PPE and to not keep inventory levels so tight.

Having said that, an overwhelming majority of 77% of the respondents think that their organization couldn’t have done anything else to better prepare for a black swan event like this pandemic

SleepTech Magazine Mattress, Accessories, Machinery, Raw Materials

SleepTech Magazine Mattress, Accessories, Machinery, Raw Materials